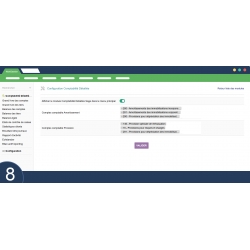

The Detailed Sage Accounting Module from NextGestion is a fully comprehensive accounting solution, designed to meet the highest professional standards. Inspired by the logic and structure of Sage software, it enables centralized, precise financial management, ensuring traceability, transparency, and efficient decision-making.

Thanks to a clean interface, dynamic reports, and advanced analysis tools, this module allows businesses to monitor their financial health in real time while producing outputs that comply with both accounting and fiscal regulations.

The Detailed Sage Accounting Module from NextGestion is a fully comprehensive accounting solution, designed to meet the highest professional standards. Inspired by the logic and structure of Sage software, it enables centralized, precise financial management, ensuring traceability, transparency, and efficient decision-making.

Thanks to a clean interface, dynamic reports, and advanced analysis tools, this module allows businesses to monitor their financial health in real time while producing outputs that comply with both accounting and fiscal regulations.

Displays all accounting entries sorted by general accounts, including date, journal, document number, description, and balance. Entries can be filtered by period, account, or label, and results exported in PDF or Excel.

Provides access to all accounting records related to third parties (clients and suppliers), with a detailed breakdown of debits, credits, and balances grouped by partner.

Summarizes debit and credit balances for each account, along with recorded movements over a selected period. This overview ensures the accounting system remains balanced.

Offers a consolidated view of client and supplier balances through third-party accounts. Essential for managing receivables and payables.

Displays the aging of receivables and payables based on due dates (current, 30, 60, 90+ days). Critical for assessing payment risk and evaluating customer payment behavior.

Tracks daily cash flow, including receipts, expenses, opening, and closing balances. Ideal for bank reconciliations and day-to-day liquidity management.

Generates detailed indicators about customer turnover, outstanding balances, purchasing trends, and growth rates. Helps identify key clients and guide commercial strategy.

Lists pending accounting entries awaiting final validation before they are officially booked. This serves as a pre-validation space, enhancing data entry control.

Allows you to generate summarized reports on global accounting activity—totals, frequencies, and entry types. Offers a macro view of business dynamics.

Lists all upcoming or overdue payments, grouped by third parties or document references. A key tool for payment tracking and reminders.

Generates a clear report of accounting assets (clients, inventory, fixed assets, etc.), offering a concise overview of the company’s financial position and asset profitability.

Richard Palmer

A very solid accounting module. The Sage export format is accurate and well structured.

Noelia Campos

Herramienta muy útil para exportaciones contables claras y sin errores.

Karin Vogel

Übersichtlich und präzise. Ideal für professionelle Buchhaltungsprozesse.

Carlos Mendes

Módulo muito completo para contabilidade detalhada e exportação Sage.

Javier Llorente

Excelente complemento contable para Dolibarr en entornos profesionales.

Patrick Nolan

Reliable and professional accounting solution. Perfect for Dolibarr users working with Sage.

Matthias Koller

Ein sehr gutes Modul für strukturierte und saubere Buchhaltung.

Alain Courtois

Module très complet pour une comptabilité détaillée et conforme. La compatibilité avec Sage est excellente.

Olivier Bianchi

Solution robuste pour une comptabilité détaillée et conforme.

Pierre Montoya

Solution très professionnelle pour relier Dolibarr à Sage. Gain de temps considérable.

Helen Crawford

This module makes detailed accounting and Sage integration extremely smooth.

Edward Lawson

Edward Lawson

Isabelle Renard: Paris

Outil indispensable pour structurer les écritures comptables. Les exports sont clairs et fiables.

Monica Barone

Ottima soluzione per una contabilità dettagliata e ben organizzata.

Stefano Rizzi

Modulo contabile molto preciso. Perfetto per l’uso con Sage.

Frank Zimmermann

Sehr leistungsfähiges Modul für detaillierte Buchhaltung. Sage-Integration funktioniert einwandfrei.

Davide Gallo (Italy)

Strumento affidabile per la gestione contabile avanzata.

Eduardo Salas

Módulo muy completo para contabilidad detallada. Excelente integración con Sage.

Tomas Jankauskas – Lithuania

Very accurate accounting module. Perfect for professional financial reporting.