The "Accounting Reports" Module is a tool that allows you to generate advanced accounting reports for a company. It offers three types of reports:

The "Accounting Reports" Module is a tool that allows you to generate advanced accounting reports for a company. It offers three types of reports:

1- Report 1 is a report on VAT declarations, which covers a specific period from January 1, 2023 to December 31, 2023. This report helps to verify the company's compliance with tax regulations and can help avoid fines or penalties.

2- Report 2 is a profit and loss report, which covers a monthly period from April 1, 2023 to April 30, 2023. This report tracks the evolution of the company's profit and loss over time . It can help identify areas where improvement is needed and help make informed financial management decisions.

3- Report 3 is a report on the Balance Sheet, which also covers a monthly period from April 1, 2023 to April 30, 2023. This report provides an overview of the assets and liabilities of the company, presenting the elements following: fixed assets (FIXED ASSETS), current assets (CURRENT ASSETS), short-term debts (CURRENT LIABILITIES) and equity (CAPITAL & RESERVES). This report is useful for assessing the overall financial health of the business.

In addition, all three reports can be exported as Excel files, making them easy to use and share.

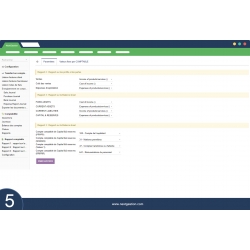

Finally, it should be noted that all the accounts for the three reports are configurable in the Module configuration. This means that the business can customize the reports according to their own needs and preferences.

Carlos Méndez

Excelente módulo para generar informes contables.

Marta Sánchez

Los reportes son claros y muy útiles para el control financiero.

Emma Collins

Perfect for monitoring financial performance inside Dolibarr.

James Cooper

Reports are well organized and accurate. Highly recommended.

Nicolas Weber

Indispensable pour avoir une vision claire de la comptabilité sans manipulation complexe.

Marco Bianchi

Modulo molto utile per i report contabili. Tutto è chiaro e ordinato.

Laura Mitchell

Great module for financial analysis. Saves a lot of time.

Thomas Bernard

Les rapports facilitent vraiment la prise de décision. Très bon complément à Dolibarr.

Elena Ruiz

Información bien presentada y fácil de analizar.

David Harris

Very useful accounting reports. Data is clear and easy to interpret.